Buying a life insurance policy in 2025 feels different from how people handled it years ago. The conversations are steadier, more down-to-earth, and far less driven by the feeling that “everyone else is buying one.” Many households now pause to look at their own numbers first, asking what a policy actually delivers and whether the premium fits their situation. A life insurance premium calculator often becomes the first tool they open, mainly because it gives them a rough idea of the commitment. The New Tax Regime also played its part. Once the pressure of buying insurance mainly for deductions faded, families began treating policies with a more personal lens. They now look at whether a plan genuinely supports long-term responsibilities instead of leaning on old assumptions.

How buying habits have changed in recent years

A noticeable shift has emerged: people are more willing to revisit their financial plans. The habit of picking a policy primarily for tax savings does not carry the same weight. Instead, conversations revolve around questions such as: “How much cover is enough?” and “Can I manage this premium every year without stretching the household budget?” Removing tax-related pressure has created room for calmer thinking. People now ask whether the sum assured would actually help their families cope with living costs or settle outstanding loans. These questions feel more practical and far closer to the way families plan their finances today.

The renewed focus on protection

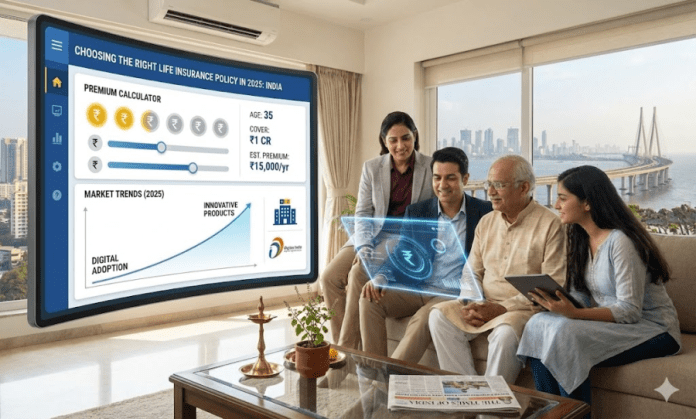

A gradual change in mindset has encouraged buyers to see life insurance as a form of security rather than a side investment. The idea is straightforward: if something interrupts the main income, the family should have support to manage ongoing needs. This view encourages people to consider the finer details of a policy. When they use a life insurance premium calculator, they often notice how even small tweaks—changing the term length or adjusting the cover—shift the premium. Younger earners are often surprised by how manageable the cost is when they start early. The calculator helps them replace vague thoughts with clearer numbers, making choices easier to weigh.

Why people rely on premium calculators

Many buyers now begin with a calculator because it removes the uncertainty around premiums. Instead of guessing, they see approximate figures almost instantly. They can try out different versions of the same policy: higher cover, reduced cover, a longer term, or an added rider. They can also see how each choice nudges the premium up or down. This reduces the chances of emotional or rushed decisions. It also prevents people from committing to a plan that looks appealing at first but becomes hard to maintain later. Several buyers have said that the calculator helped them realise they could adjust the policy structure slightly and find a more comfortable balance.

The place of advisers in this new approach

Digital tools have become common, but advisers remain part of the process for many families. What has changed is the expectation. Buyers now prefer advisers who speak plainly, without jargon or stiff sales phrases. They want explanations grounded in their own life—dependants, income, loans, and long-term goals. Advisers who take this approach often find that discussions run more smoothly. Families respond positively to someone who listens rather than persuades. This has quietly raised the standard of advice, turning the process into a shared evaluation rather than a quick transaction.

Technology’s growing influence on everyday insurance decisions

Technology is involved in almost every step now. Applications are faster, verification is less cumbersome, and tracking documents is simpler. Automated checks also help reduce avoidable delays during claims or underwriting. For buyers, these changes remove much of the hesitation that used to surround life insurance purchases. Fewer forms, fewer repeats, fewer waiting periods. Premium calculators also benefit from better data inputs, making the estimates steadier and more reliable. Many people appreciate that they can understand the basics on their own before speaking to anyone.

Trends shaping choices in 2025

Some patterns have become clearer this year. Families lean towards straightforward plans that clearly state what the policy covers. Complicated layers tend to put people off, so simpler structures see more interest. Flexible premium options are also becoming more appealing, especially for younger earners whose income may shift from year to year. A growing number of people now conduct their own research before speaking to an adviser. They compare policies, read documents, and run numbers through calculators ahead of time. This helps them enter conversations with better clarity and reduces the chance of choosing a policy that does not match their expectations.

Bringing all these ideas together

Choosing a life insurance policy in 2025 depends on understanding your family’s needs and checking which policy aligns with those needs without strain. A life insurance premium calculator offers a fair starting point by showing what is realistically affordable. Market behaviour hints at what other families value, but the final choice always rests on personal priorities. When these tools and insights are combined with honest guidance and sensible reflection, selecting a long-term policy becomes less overwhelming. Most families find that steady evaluation leads to stronger decisions, and that approach is shaping how life insurance is chosen today.