Most people will normally contact the IRS to file their individual income tax returns and receive their 1099 benefits. Some people were exempt from filing their taxes every quarter before implementing the new improvements and tax reduction payments. These factors are provided below for filling. Even if you don’t want to, submitting a 2021 tax return could result in financial rewards. However, many people are not required to file quarterly tax filings if their pay is below a specific threshold. A person may qualify for special tax advantages or have already paid some federal income tax by having charges deducted from checks if they meet all the requirements for a tax refund that can only be claimed by submitting a return. To determine how much tax is due, utilize a self-employed tax calculator or ask a CPA in the FlyFin app to help you through the tax filing process.

Electronic filing and direct transfer are advised for a return as soon as possible: This year, avoiding refund delays makes electronic documentation with direct transfer and avoiding a paper tax form more important than ever. The IRS anticipates that most online filers who select online deposit will get their refunds three weeks after submitting their information. If you want your return quickly, using software, a personal tax advisor, or a Free File while filing your taxes is advisable.

Incorporate payments for the Child Tax Credit in advance.

You must file quarterly taxes using the 2021 tax form if you got advance payments. You must consider the growth of the payments you received when calculating the child tax credit amount to guarantee your 2021 tax return. Anyone successful using the Non-filer tool is also included. The IRS will send you Letter 6419 in January 2022 and the full advance Child Tax Credit installments you received in 2021. To prevent a delay in processing, you must have the whole amount and look for the IRS Letter 6419 before filing. If you don’t receive a letter or have questions about how much you’ve been paid, you can check the total amount of your Child Tax Credit payment, even if it was advanced, using your online account with the IRS.

Those who were not qualified for the Economic Impact Payment during the third round or who received less money than anticipated may still be able to claim the Recovery Rebate Credit based on their 2021 taxes. Regardless of how frequently they submit a tax return, those who qualify should do so in 2021 to ensure the Recovery Rebate Credit. The full amount of their third Economic Impact Payment, including any supplemental or “in addition to up” payments, must be submitted with their return to avoid a processing hitch that could delay their refund. In the middle of 2022, the IRS will send Letter 6475 to inform you of the third Economic Impact Payments total. By entering into their IRS Online Account with their current ID or their IRS Online Record login, users can also securely view the amounts of their Economic Impact Payments.

Simpler tax filing requirements in 2022

Everyone should consider tax preparation’s importance, including people who often don’t file tax returns. Here are some crucial guidelines for submitting a precise and comprehensive 2021 tax form:

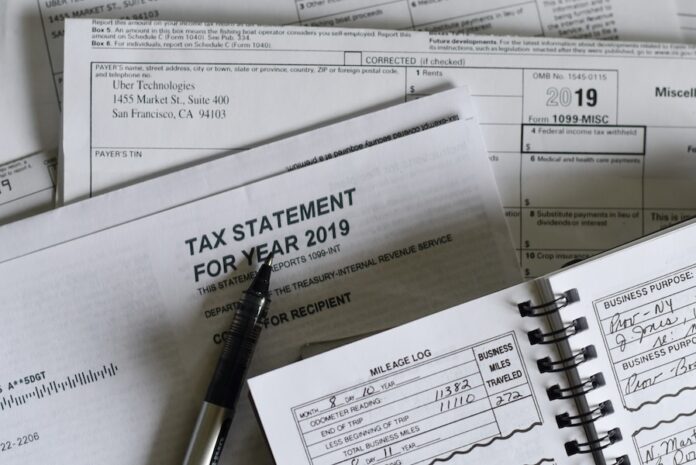

-Acquire any relevant records, including W-2s, 1099s, receipts, bounced checks, and other documents, that will help with a pay item, a tax deduction, or a credit that appears on a federal form.

-Assemble all of your year-end pay documents, including Forms 1099-MISC for other income, Forms 1099-INT for interest income, and Forms 1099-NEC for statements from the health insurance exchanges.

-Build an organizational framework that stores all the necessary data in one location, such as an electronic records management system or a file organizer for paper files in recognizable envelopes. Creating a government form is simpler when all the required documentation is readily available.

Citizens should wait to record their information until they have all of the 2021 tax information to avoid processing delays that could affect tax refunds. File your tax returns for self-employment promptly.

As a result

As previously said, the abovementioned methods are the most effective for filing tax returns. Use software-driven processes to file your paper. Thanks to this, you can easily check the tax payments and all of your earnings if you’re a self-employed person. If you open a business bank account, keep in mind that it can help you keep track of business transactions and save you time when it comes to filing your taxes.