Crypto trading is a field of activity that is gaining popularity among people trading with the aim to get stable and high income from the market. The important thing that can help to get success is strict compliance with the rules relating to risk management. Using special functions on the Cryptorobotics trading platform makes consistent returns and reduces losing your capital. But it is necessary to choose some that will be suitable for your trading process. In this article, we will consider four popular risk management techniques that must be used in crypto trading.

Today, the most popular best features are considered Stop Loss, Take Profit, Trailing Take Profit, and Trailing Stop Loss. These functions are able to minimize the loss of funds and increase profits. Besides, you can place these types of orders absolutely free in the Cryptorobotics terminal. Let’s take a look at each of these functions.

What is Take Profit?

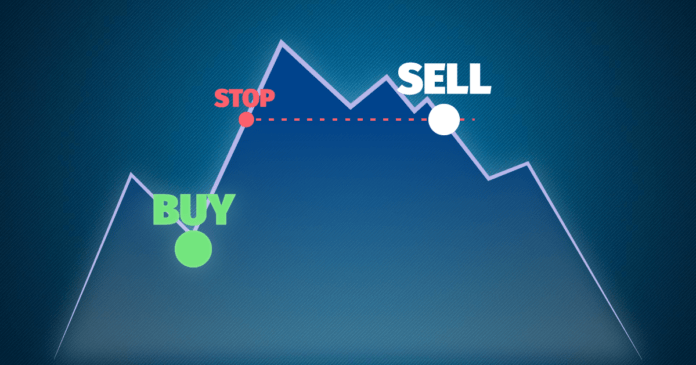

Take Profit is a type of order that indicates the price at which the order will be closed in profit and plays a key role in the strategy of many crypto traders. When prices start to rise, these orders are used as an upper limit and ensure that coins are sold before prices begin to fall.

Take profit helps to avoid mistakes that are very often made by traders during the trading process. For example, when you open an order, you can fix the price at which you are ready to exit the trade. This way, you don’t make the mistake of exiting the trade too early or too late.

Despite the fact that Take Profit guarantees a profit, it is quite possible that the order will be filled and prices will continue to rise. Accordingly, you may miss out on the chance to make more substantial profits. In addition, there exists the potential of human error, so always check your settings are correct to avoid mistakes that could cause you losses.

What is Stop Loss?

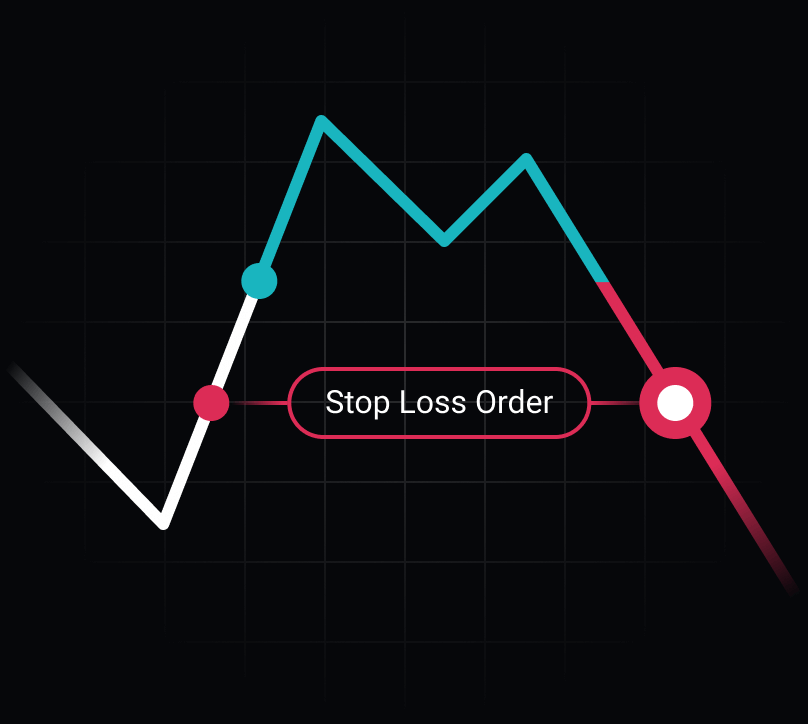

Stop Loss orders allow traders to automatically place their cryptocurrency for sale if its cost falls below a certain price. This type of order helps prevent losses when the crypto market has a downturn and also eliminates emotions when trading. Stop Loss orders allow investors to think ahead of time about the price at which they want to sell their digital coins, preventing rash and potentially unprofitable decisions. Such an order also relieves traders of the need to constantly monitor changes in the market. Selling actions will occur automatically if prices fall to a preset level.

What is Trailing Stop Loss and Trailing Take Profit?

Trailing is a stop order that can be customized to fix an interest or amount of coins at a lower or higher current cost of an asset in the market. This tool can minimize losing funds and maximize returns.

So, the Trailing allows traders to move the price level to execute Stop Loss or Take Profit orders.

Every trader can bind a Trailing to Take Profit and Stop Loss. What is it for?

First of all, not all traders can constantly monitor their computers and control the trading process. Second, Trailing will help you avoid losses if a market trend reverses.

What is a Trailing Take Profit?

A Trailing Take Profit is intended for moving the price on the chart while it is rising.

What is a Trailing Stop Loss?

A Trailing Stop Loss aims to move down on the chart when the cost of a digital coin is falling.

Trailing is a crucial function in crypto trading and can significantly improve the traders’ income. However, it is recommended to set it up if you have appropriate experience in crypto trading, as it demands good skills and knowledge to configure it.

How to customize Take Profit, Stop Loss, and Trailing in Cryptorobotics trading terminal?

These features are available in the Cryptorobotics trading terminal, which helps traders simplify the entire trading process. Let’s take a closer look at how Take Profit, Stop Loss, and Trailing can be set up on this trading platform.

In order to customize these tools, you should complete the following steps:

- Pass registration process.

- Set up an account on one of the exchanges available on the platform.

- Bind the created account to the trading platform via API key.

- Click on the “Trade” button.

- Select the exchange and the crypto trading pair.

After that, you will be able to customize the Take Profit, Stop Loss, and Trailing.

If we take into account Stop Loss and Take Profit are intended to fix profit and loss, you need to open a current trade-in which these orders will be placed. Then, you should place market, limit, or stop-limit orders. For instance, we will customize a limit order to set up a Stop Loss, Take Profit, Trailing Take Profit, and Trailing Stop Loss. To start a customization process of the limit order, you should click on the “Buy” or “Smart orders” button and you will be able to see the drop-down menu.

In the drop-down menu, you should specify the following points:

- The price of the coin you want to buy (it can also be customized by moving the level on the chart).

- The number of purchased coins.

- The percentage of the preferred deposit.

- The basic coin.

- Configure Stop Loss, Take Profit, Trailing Stop Loss, and Trailing Take Profit.

When you complete all the steps, you will be able to start crypto trading.

It should be noted that it is not worth configuring Trailing Stop Loss during the flat market as it can minimize your returns.