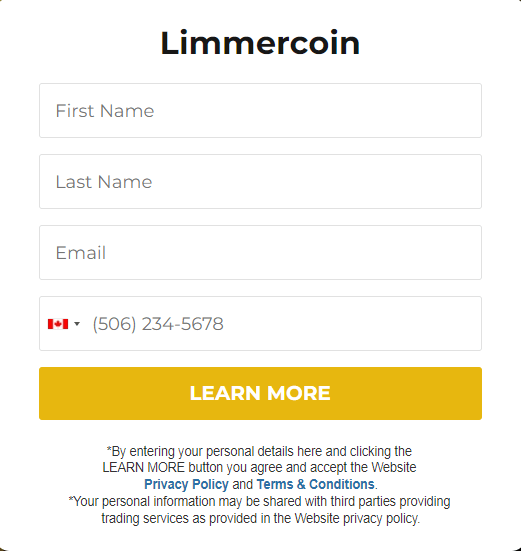

Wrapped Bitcoin (WBTC) offers a gateway to Bitcoin’s price trajectory and the decentralized finance (DeFi) landscape. This article demystifies WBTC and its benefits. If you’re new to Bitcoin trading, don’t worry! Click on the below image link to execute profitable trades with ease, even without prior experience.

Benefits of Investing in Wrapped Bitcoin

Firstly, WBTC provides investors with exposure to Bitcoin’s price movement without directly holding the underlying asset. As WBTC is backed by actual Bitcoin, its value is directly linked to the price of Bitcoin. This allows investors to participate in the potential gains of Bitcoin without the need to manage and secure physical Bitcoin themselves.

Additionally, WBTC offers enhanced liquidity compared to traditional Bitcoin. By tokenizing Bitcoin on the Ethereum blockchain, WBTC becomes easily tradable on decentralized exchanges (DEXs) and other platforms. This increased liquidity allows investors to buy, sell, or trade WBTC with greater ease, potentially capitalizing on market opportunities more efficiently.

Furthermore, investing in WBTC grants access to the rapidly expanding DeFi ecosystem. WBTC can be seamlessly integrated into various DeFi protocols, enabling investors to participate in yield farming, lending, and other decentralized financial activities. This integration opens up a world of possibilities for investors to earn passive income or engage in sophisticated DeFi strategies using their WBTC holdings.

One significant advantage of WBTC is the added layer of security and transparency it offers. The tokenization process involves stringent custodial practices and regular audits to ensure that the number of WBTC tokens in circulation matches the actual Bitcoin reserves. This transparency reduces the risk of fraudulent activities and provides investors with greater confidence in the integrity of WBTC.

Moreover, WBTC bridges the gap between Bitcoin and the Ethereum blockchain. This interoperability allows WBTC to be used in various applications and services within the Ethereum ecosystem. For instance, WBTC can be used as collateral for borrowing other cryptocurrencies or as a medium of exchange for decentralized payments and remittances. This versatility expands the utility of WBTC and provides investors with additional opportunities to leverage their holdings.

How to Invest in Wrapped Bitcoin

Start by selecting a reputable cryptocurrency exchange or trading platform that supports WBTC. Ensure that the platform has a strong track record, provides robust security measures, and offers a user-friendly interface. Popular platforms such as Binance, Coinbase, or Kraken often support WBTC trading.

Next, create a cryptocurrency wallet that supports WBTC. You have the option to choose between a hardware wallet, a software wallet, or a web-based wallet. Hardware wallets like Ledger or Trezor offer enhanced security by storing your WBTC offline, while software wallets such as MetaMask provide convenient access through a browser extension. Make sure to follow the wallet provider’s instructions for creating and securing your wallet.

Most cryptocurrency platforms require users to undergo a Know Your Customer (KYC) verification process. This typically involves providing identification documents and proof of address. Complete the necessary steps to verify your account, ensuring compliance with regulatory requirements.

After your account is verified, deposit funds into your chosen platform. Depending on the platform, you may be able to deposit fiat currency (e.g., USD, EUR) or other cryptocurrencies (e.g., Bitcoin, Ethereum) that can be exchanged for WBTC. Follow the platform’s instructions to deposit funds into your account.

Once your account is funded, locate the WBTC trading pair on the platform. WBTC is often paired with Ethereum (ETH), so look for the WBTC/ETH trading pair. This allows you to trade your ETH for WBTC or vice versa.

Decide whether you want to buy or sell WBTC. If you wish to buy WBTC, specify the amount of WBTC you want to purchase and review the current market price. You can place a market order to buy at the prevailing market price or set a limit order to buy at a specific price. Confirm the details and execute the trade.

After the trade is completed, transfer your WBTC from the exchange to your personal wallet. This step is crucial to ensure that you have control over your WBTC and reduce the risk of theft or hacking. Use your wallet receiving address to initiate the withdrawal from the exchange and verify the transaction.

Conclusion

Investing in Wrapped Bitcoin (WBTC) presents a compelling opportunity for new investors to gain exposure to Bitcoin’s price movement and leverage the benefits of the decentralized finance (DeFi) ecosystem. With its seamless tokenization, enhanced liquidity, and integration with Ethereum, WBTC offers a secure and versatile investment option.