A bank account is an essential financial tool for managing your finances and conducting transactions. Whether you are an individual, a business owner, or an expatriate, having a bank account can make it easier to manage your money, pay bills, and save for the future. In this article, we will provide a comprehensive overview of the process for opening a bank account, including what to consider when choosing a bank, the required documentation, and the steps involved in the account opening process. By following these steps, you can ensure a smooth and efficient experience when opening your new bank account.

Mauritius is a small island nation located in the Indian Ocean that offers a stable economy, a favorable tax regime, and a growing business sector. These factors, along with its attractive lifestyle, have made it an attractive destination for foreign investors and expatriates. As a result, opening a bank account in Mauritius has become a common requirement for those looking to conduct business or invest in the country.

Mauritius has a well-developed banking sector and a favorable tax regime, making it an attractive destination for foreign investors and expatriates. As a result, opening a bank account in Mauritius has become a common requirement for those looking to conduct business or invest in the country. But is it difficult to open a bank account in Mauritius? The answer is it depends.

Some banks have established procedures for opening accounts and can assist you with the process, making it a relatively simple and straightforward process. However, there are certain requirements that must be met and documents that must be provided, and these requirements can vary between banks. Here are the steps you need to follow to open a bank account in Mauritius:

- Choose the type of account you need: There are several types of bank accounts available in Mauritius, including current accounts, savings accounts, fixed deposit accounts, and offshore accounts. Determine the type of account that best suits your needs based on your financial situation and the type of transactions you expect to make.

- Choose a bank: There are several local and international banks operating in Mauritius. Research the options available and choose a bank that meets your requirements. Take into consideration factors such as fees, interest rates, and the level of customer service offered.

- Gather required documents: To open a bank account in Mauritius, you will need to provide a number of documents, including proof of identity (such as a passport), proof of residency (such as a utility bill), and proof of income (such as a salary statement). You may also need to provide a reference from your current bank.

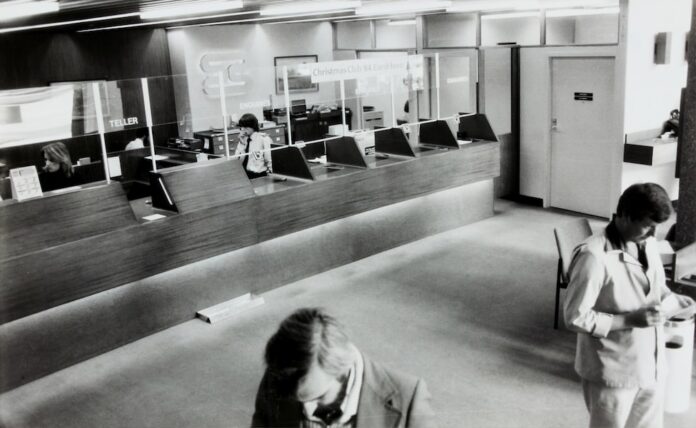

- Visit the bank in person: Most banks in Mauritius require customers to visit a branch in person to open an account. This allows the bank to verify your identity and complete the required documentation.

- Complete the application process: You will be required to complete an application form and provide the required documentation. The bank may also conduct a credit check and may require additional information, such as the purpose of the account and the source of funds.

- Fund your account: Once the application process is complete and the account is open, you will need to deposit funds into your account to activate it. This can be done by transferring funds from your home country or by making a deposit in person at the bank.

- Start using your account: Once the account is open and funded, you can start using it for your transactions. You will receive an ATM card and cheque book, which can be used to access your funds. You may also be able to set up online banking and mobile banking, which will allow you to manage your account from anywhere in the world.

Opening a bank account in Mauritius is a time-consuming process that requires careful planning and preparation. By following the steps outlined above and working with a reputable bank, you can quickly and easily establish a bank account in this attractive and growing market.

Are There any Benefits of Opening a bank account in Mauritius?

One of the key benefits of opening a bank account in Mauritius is the favorable tax laws. Mauritius has a territorial tax system, meaning that only income earned within the country is taxed. This makes it an attractive destination for individuals and businesses looking to reduce their tax burden. In addition, the country has a number of tax treaties with other countries, further reducing the tax burden for foreign residents and businesses.

Another benefit of opening a bank account in Mauritius is the stability of its political and financial systems. Mauritius has a stable government and a well-developed financial sector, making it a safe and secure destination for individuals and businesses seeking to manage their finances. The country is also a member of the Common Market for Eastern and Southern Africa (COMESA), providing access to a large and growing market for businesses looking to expand their operations.

However, it is worth noting that the cost of opening and maintaining a bank account in Mauritius can be higher than in other countries. Banks in Mauritius typically charge higher fees for services such as account maintenance, foreign currency transactions, and wire transfers. In addition, the process of opening a bank account in Mauritius can be more complicated than in other countries, requiring documentation such as a passport, proof of address, and a reference letter from a current bank.

Opening a bank account in Mauritius can be profitable for individuals and businesses looking to take advantage of the country’s favorable tax laws, stable political system, and developed financial sector. However, it is important to consider the potential costs and requirements involved in the process of opening a bank account in Mauritius. Before making a decision, it is advisable to carefully research the different banks and financial institutions operating in Mauritius and to compare the fees, services, and requirements offered by each. By researching the different banks and their requirements, gathering all necessary documentation, and having a clear understanding of the purpose of the account and the source of funds, you can ensure a smooth and efficient account opening process.

To sum up, while the process of opening a bank account in Mauritius can be different depending on the specific bank and the type of account you are opening, it is not necessarily a difficult process. By preparing in advance and working with a reputable bank, you can successfully establish a bank account in this attractive and growing market.