Introduction

In a rapidly changing financial world you need to be on top of market news and information to make informed investment decisions. With so many new tools available, the use of solutions that are closely aligned with your workflow can improve productivity, output quality, and provide you with opportunities that were impossible before.

This list covers the top 8 stock analysis and investment research services online in options, equity, cryptocurrency bitcoin and futures trading with features, pricing, promotions. Whether you’re a beginner looking to learn or an existing expert hoping to hone your skills, this guide will help you find the perfect tools for you throughout each step of stock analysis and up your game.

Website List

1. BestStock AI

What is BestStock AI

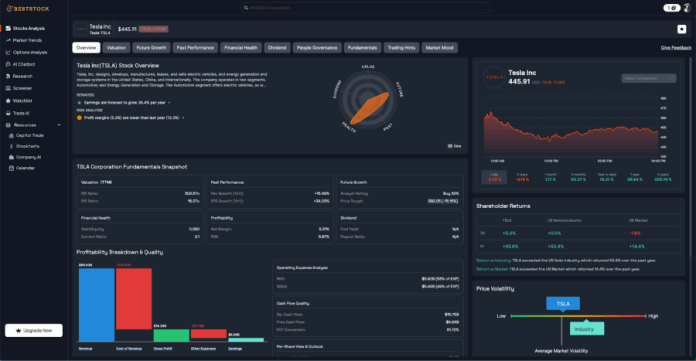

BestStock AI is an AI-powered Stock data processing platform with a mission to provide our users best global financial market data in the shortest time. It is an automated financial analysis system for professionals and long term investors which doesn’t require any manual work. BestStock AI utilises a mix of deep corporate financial intelligence, combined with AI powered insights, to then educate users enabling them to be better investors. It also has a badass stock compare feature to do an instant quick analysis between many tickers side by side on Key fundamentals, valuations, operating metrics and earnings performance in up to 50+ columns so you can quickly find the winners.

Features

- Financial analysis using AI that processes data automatically and helps make decisions without any manual recesses

- State-of-the-art market intelligence – including full corporate financials and daily AI insights – to make the smartest investment decisions possible

- Advanced statistical & business analytics tools enabling better visualization of your data for making good decisions.

- Intuitive research flow to help you make decisions more efficiently and enhance your investing effectiveness

- User feedback based continuous improvements and updates for best performance and satisfaction

Pros and Cons

Pros:

- Financial analysis is AI driven and generates useful insights without any manual work

- Extensive US stock financials and earnings transcripts

- Competitive analysis in synergy with statistical and business reports

- Easy to use helping professionals and investors do their research faster

Cons:

- Premium features can be an investment when compared to other market data platforms.

- Lack of full mobile app access may slow you down on the go

- Less functionality in offline mode—must be connected to the internet to access all functionality

2. Webull

What is Webull

Webull is an all-in-one self-directed trading platform that allows you to invest in stock, options, ETFs and cryptocurrency for free. While providing ease of use and accessibility, it has a full array of tools and services available, that traders can utilze to manage their portfolios with ease. Its live quotes and paper trading make it perfect for new investors, Meanwhile it’s personalized investment options make it ideal for professionals who are looking to build an investing career.

Features

- Broad selection of investment products, from stocks to cryptocurrencies to interest-paying savings accounts

- Advanced trading features – overnight trading options and margin prediction markets

- Intuitive mobile and desktop trading apps that make placing orders a snap

- Privacy Policy: in the latest version of the app, all the information you share is securely and safely encrypted.

- Real-time update with live-streaming quotes

- Strong cash management offerings with competitive APY for your recurring investments and retirement accounts

Pros and Cons

Pros:

- Plenty of investment options, from stocks to crypto to ETFs

- Intuitive platform and apps with the ability to trade all the most popular investments (U.S. single stocks and ADRs, ETFs, options) in one place

- Desktop and mobile app versions are easy to navigate

- Added features such as overnight trading and margin prediction markets

- Live quotes and advanced trading tools

Cons:

- Steeper learning curve to master advanced features may need more training

- Potential for higher fees than at some discount brokers

- Minimal support for offline trading modes

3. Robinhood

What is Robinhood

Robinhood is a no-fee trading platform that offers easy access to all kinds of investment products, including stocks, options, ETFs and cryptocurrencies. The primary goal of it is to democratize finance and provide an intuitive trading experience, with the additional asset of open access to market trends, so users can grow their investments accordingly. Driven by such features as 24/5 trading and the ability to get started with little money, Robinhood offers very ordinary people a way to fend for their future.

Features

- Intuitive trading tools for easy strategy development and market trend tracking

- Trade top stocks, ETFs, and options commission free with a starting balance of $0

- Full asset management by professionals

- Flexible transfer options for crypto and stocks with bonus promotions

- Effortlessly combine your target trades with Robinhood Financial services for a smooth trading experience

Pros and Cons

Pros:

- Intuitive tools to trade directly from the price chart and customise your trading platform.

- You have the ability to trade a wide variety of assets such as stocks, options and even cryptocurrencies

- 24/7 trading means around the clock investment opportunities.

- The ability to invest in a self-directed brokerage account with special bonuses

Cons:

- More expensive fees than some other trading platforms

- Limited ability to trade and invest offline

- Mobile app features may not be a fit for all users

4. AAII

What is AAII

Founded in 1978, the American Association of Individual Investors is a nonprofit organization that arms individual investors with the wisdom and knowledge of knowing how to take control of their finances and investments. Its primary goal is to enable its members to “earn better returns on their investments,” as data shows AAII members often outperform the S&P 500. Investors who become AAII members can benefit from priceless advice and guidance to improve their investing experience.

Features

- Pro investment strategies that enable the individual investor to outperform the SP 500 by nearly 3x

- An exclusive membership to a members-only stock portfolio for long term growth and profitability

- Robust retirement planning and wealth accumulation solutions-focused resources and tools

- Creating community involvement that promotes investor cooperation and knowledge sharing

- Tips and news on market trends to help keep you ahead of the curve

Pros and Cons

Pros:

- Good history of individual investors beating the S&P 500, a sign of strong investment strategies

- A Friend Feed for inspiration from other members in the community, and to share and view combined insights.

- A wide range of educational materials aimed at arming individual investors

- A low vanity price of membership for a competitive value proposition for investors

Cons:

- May have too much information for the new investor and may be a steep learning curve

- Lack of customization for particular investment strategies or preferences

- Possibly not ideal for more advanced investors who are looking for specialized or niche investment advice

5. Moneycontrol

What is Moneycontrol

Moneycontrol is a one-stop destination for trending financial news from around the world, with in-depth analysis of stocks and markets’shocks and trends across market shares such as BSE & Nifty. Its primary goal is to provide investors and traders with easy access to market data, economy trends and finance news without its being filtered by traditional media. With live share & stock market prices at your fingertips, keep track of Indian and Global financial markets with Moneycontrol – the most reliable source for personal finance, economy, business news and stock market updates.

Features

- In-depth market analysis from experts and data trends

- Live rates of associated markets are also provided to help make investment callertions.

- What to watch in markets and the latest news from New York

- Anticipation and economic change factors such as interest rate expectations

- Intuitive easy navigation and convenient access to key finance information

Pros and Cons

Pros:

- A strong recovery in the markets, with Sensex gaining 550 points from day’s low

- Strong investor sentiment around the anticipated RBI rate-cut

- Substantial advances in important sectors, especially in the metal counter like Hind Zinc and Tata Steel

- Growing market capitalization for companies such as Groww, showing growth potential

Cons:

- Continued geopolitical tensions could roil the market

- Relying on external factors like inflation rates can result in market turmoil

- Worries that business executives could feel the long arm of a crackdown may give investors pause

6. Tickeron

What is Tickeron

Tickeron is a web-based financial analytics platform that features AI and machine learning to provide interactive data, charts, indicators and prediction modules for all traders, retail and institutional. It is designed to make the investing process we really want right now – simple, enjoyable and easy, with data-driven real-time insights at our fingertips every day, in every decision. Browsing is made easy with an intuitive interface and cumulative resources in such a way that Tickeron helps users find their way to success.

Features

- Next-gen automation features that boosts productivity and simplify workflow

- Personalized insights and performance metrics on customizable dashboards

- Strong security measures for data protection and privacy compliance

- Built-in communication functions for information exchange more easily

- Multiple support channels, including tutorials and 24-hour customer service

Pros and Cons

Pros:

- Memorized pattern recognition by AI, probabilistic signals reduce the need of manual charting.

- Backtest trade ideas where a win rate/confidence is provided can also be ranked by how well you did when you initiated those signals.

- Systematic, rules-based trading is supported by trend bots and trade alerts.

- All-in-one asset coverage (stocks, ETFs, options, crypto, forex) in one place.

- Visual dashboards and heatmaps help you scan for opportunities at a glance.

Cons:

- Full-featured and live data on premium tiers can be pricey.

- The learning curve is fairly sharp because of its several modules and configurations.

- The black-box AI reduces transparency and the ability to minutely customize a deployable classifier.

- Signal strength will vary; more false positives in choppy markets.

- Tech and/or quant tools as specialty; not much depth in fundamental research.

7. Earnings Whispers

What is Earnings Whispers

Earnings Whispers is the only provider of real, professional whisper numbers for professional traders and investors – the most reliable earnings expectation availabe – based on superior fundamental research that is combined with investor sentiment data, quantitative studies, and technical analysis to create a valuable indicator for favorable trading and investment decisions. The site compiles earnings sentiment data and tracks investor’s which companies are attracting the most interest – so you can make informed decisions. Its unique value is providing the most current and relevant earnings report news possible, allowing investors to make better decisions with quickly actionable data.

Features

- In-depth earnings sentiment analysis and review of investor trends and purchase behavior

- Stay current with instant updates to positive earnings news for well-timed decisions

- Detailed analysis of earnings releases to help with investment strategies

- Intuitive interface that provides easy access to vital financial insights

- Customized alerts for big trading events so you can keep on top of the latest news and surprises

Pros and Cons

Pros:

- Serves fresh earnings news with a shot of investor enthusiasm

- Provides earnings sentiment, giving users an idea of how the market is reacting

- Emphasizes both past positive and expected positive earnings, for investment choices

- Connects users with discussions about earnings, to be part of the conversation on an informed investing community

Cons:

- Less comprehensive analysis for earnings reports details on less popular companies may be missing

- Hard to filter down to only certain earnings discussions

- Risk of too much information, with updates delivered and debates proliferating daily

8. AlphaInsider

What is AlphaInsider

AlphaInsider is an open space for trading strategies, where you can buy or sell any investment strategy and also share different ways to invest on. It is designed to support traders in their decision making process, connecting them with large number of strategies, from amateurs up to professionals, that can help look at the market in new ways. They contribute to the community by democratizing trading knowledge and help traders optimize their performance.

Features

- User friendly GUI that ease and increase the user experience & shorten the learning curve

- Wide range integration possibilities with established tools to never interfear any work flow

- Strong security policies to shield sensitive data and to stay in compliance.

- Dashboards can be customized to suit each user’s personal preferences and use cases

- Realtime analytics to make faster, data-driven decisions as a team

Pros and Cons

Pros:

- Concentration on insider trading and Form 4 filings assists part the wheat from chaff when it comes to corporate insiders bearing an edge in their company.

- Collects, scrubs, and ranks insider transaction (purchases-by-size, cluster-buys: triple-plus clusters, significant buys/sales) in a way that is designed to identify meaningful opportunities.

- Alerts and watchlists that list unusual insider activity like the purchase of stock give readers ideas to look into.

- I combine insider signal (knowledge that is available only to corporate insiders, such as officers and directors) with basic fundamentals/technicals for associated contexts into swing trades primarily.

- Relevant filters (sector, market cap, transaction size, officer role) enhance relevance and reduce noise.

Cons:

- “Trader” things Insider activity is not an edge itself; but, rather a signal that can be leading or not indicative of anything without more to it.

- Coverage and freshness: Coverage depends on the SEC filing latency; intraday traders may find it slow.

- Survivorship and selection bias if the rankings overweight big flashy trades.

- Limited level of comprehensive equity research versus full-service platforms; more niche than generalist platforms.

- Some advanced features and long history may be paywalled, raising overall cost vis-a-vie alternative solutions.

Key Takeaways

- The top stock analysis tool for you will vary depending on your individual investment strategy and market type.

- History and predictive analytics should count for more than, well, the latest stock price.

- The ability to integrate with your current financial software can really help you speed up your trading.

- The user experence and the learning curve of the analysis platform must be taken into consideration to make effective decisions as quickly as possible.

- Active development and a strong research community point to a healthy, growing tool that still supports what is happening in the market.

- Risk management tools and financial regulation compliance are necessary aspects of responsible trading behaviour.

- Community support and educational material quality can undoubtedly solidify your stock analysis skills and investment success.

Conclusion

Summary Lines for Stock Analysis Software Before we conclude this overview on the best 8 stock analysis software, here are a few facts which can help you to find the ideal solution: “Stocks are growing as long as business is growing. Every tool has its strength but there are meaningful differences undertaking considerations for your needs, your wallet and future aspirations.

These are definitely interesting times for the stock analysis world and we are constantly rolling out new improvements and features. We suggest that you begin with ones that best suit your imminent requirements yet are also designed for their ability to be “scaled” and quickly adapted as your demands evolve. Also, keep in mind that the most expensive is not always the best, and just because something has more features than another one doesn’t always mean it’s going to be better for what you need.

Use free trials, demos and tools to get hands-on experience with the tools – whatever fosters creativity & innovation, customers should be seriously evaluating it. Don’t also forget to ask customer support teams questions- many will assist in this time of need from buyers! The right stock analysis software will make all the difference in your success, and put you on the profitable side of things, as long as you follow a good strategy. Begin to explore these choices for better financial decisions today!