Black Friday and Cyber Monday are the biggest shopping days in the United States. It is also particularly important for the e-commerce platform Amazon, which has occupied the top spot in Black Friday consumption in the United States in previous years.

This year, Amazon’s Black Friday and Cyber Monday were held from November 18 to December 1, first in Europe and then in Australia, the Middle East, North America, Japan, and other global sites. Black Friday and Cyber Monday were held on the main US site from November 24 to November 28. Data show that this year is the peak of online shopping spending in the US, with sales up 2.8% year-on-year.

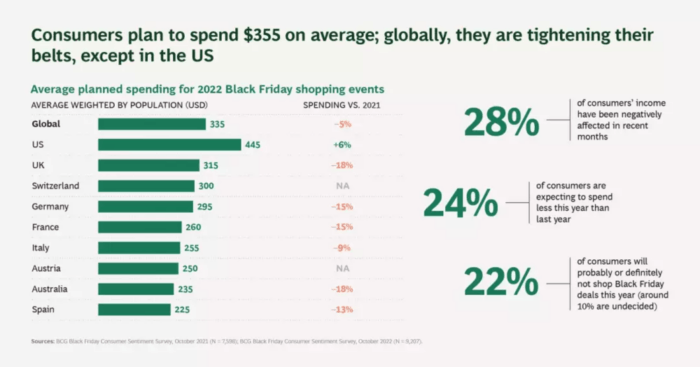

This year’s Black Friday shopping season was relatively quiet, both online and offline. The reason is that since October, major offline shopping malls and online platforms have frequently promoted sales, consumers have “stocked up on discounted goods,” and inflation has made many people voluntarily downgrade their consumption and reduce their spending. Thanks to the year-end Thanksgiving holiday and the quadrennial World Cup, many Amazon sellers are looking forward to this year’s Black Friday. But at the end of Black Friday, many sellers said that the results of the United States station were fair. The European station can be used to describe “dismal.” Meanwhile, just before Black Friday, Amazon announced that it would raise logistics and storage fees, making some sellers not participate in this year’s Black Friday due to the pressure of profit. And Amazon itself is in danger. This year, Amazon made a rare fall from its Black Friday perch, dropping from No. 1 to No. 4 on the Black Friday search list, behind Walmart, Target, and Kohl’s.

This year’s Black Friday, in the global market heat, has been different from previous years. In earlier years, shoppers traditionally lined up overnight on Thanksgiving night to wait for stores to open, but this year there has been no scramble. On the social media platform, many users posted pictures of the mall with few people, saying, “the prices are good, but it is very quiet” and “some stores are not as crowded as expected, and there are no checkout lines.” The online Black Friday data saved some face for this year’s Black Friday. According to Adobe Analytics, U.S. consumers spent $9.12 billion online on Black Friday this year, up from $8.92 billion in 2021 and $9.03 billion in 2020, driven by deep discounts on phones, toys, and fitness equipment. In addition, online sales this year reached 11.2 billion dollars, up from 10.7 billion dollars last year.

According to the analysis, the prolonged cycle, the decline of discounts, inflation, etc., are the reasons why Black Friday is no longer popular. This year’s promotions are no longer limited to the days before and after Black Friday, giving consumers more choices and spreading orders. The push even started in October. Offline retail giants such as Macy’s, Walmart, Target, and Best Buy kicked off weeks-long promotions back in October. Amazon also took the unprecedented step of launching an early morning premium for Prime members in October. Still, Amazon’s revenue from the event was down about 40% from Prime Day in July, according to data.

Compared with previous Black Friday shopping seasons, when inflation pushed up prices in some categories, the price cuts actually eased this year, depressing consumer demand. Clothing was the only cheaper category this year compared with Black Friday last year, with inflation pushing up prices for appliances, beauty products, electronics, furniture, and toys, according to DataWeave, an e-commerce analytics firm. The discounts retailers are offering in these categories aren’t enough to offset inflation, meaning consumers are still paying more than they did a year ago.

Black Friday and Cyber Monday, at the end of the year, are supposed to be good times for sellers to boost their numbers. In the first half of this year, most Amazon sellers have yet to recover from losses caused by higher tax costs last year, and a backlog of inventory has added to the pressure.

“Quiet” and “the most difficult Black Friday” are the feelings of many cross-border sellers on this year’s Black Friday. A seller said that in previous years Black Friday was the whole category of traffic, and a single volume would rise. The head is “burst single,” but this year, there is no such feeling. Among the sellers who participated in the Black Friday event, the performance of the sellers in the US station was about three times that of the usual, with the overall growth rate slowing down from last year, while the sellers in the European station saw dismal sales. A number of sellers participating in Black Friday said that this year’s Black Friday and Net One profits had dropped significantly compared to last year, mainly due to the increased cost of logistics and warehousing. Just ahead of Black Friday, Amazon US posted a price hike notice, saying that its logistics fees will be adjusted from January 17, 2023. To be specific, Amazon Logistics’ delivery fees, off-peak storage fees, storage usage surcharges, overage inventory surcharges, and additional removal and disposal fees will be increased in 2023. “It is often said in the industry that ‘to be Amazon is to be a pile of inventory’. Now Amazon’s price increase will disrupt sellers’ preparation and delivery plans for Black Friday and make many sellers with large inventories miserable.” CouponBirds’ financial expert Natalie Warb analyzes Amazon as trying to transfer their own operating costs to the seller.

Black Friday still matters to sellers, but sellers are more rational about it. More sellers are no longer pinning their hopes on the “Black Friday” days but are looking for overall sales. After Black Friday, sellers are preparing for the Christmas season. Several sellers expressed hope that by the end of December, the United States station can reach a small profit, and the European station can maintain the status quo.

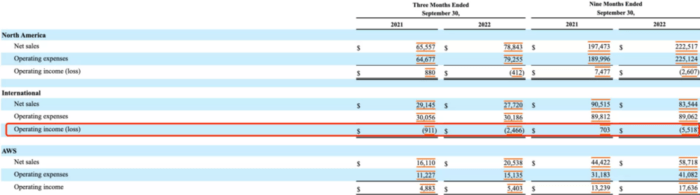

Amazon’s results, as well as its second Prime Day for the first time this year, suggest that the company’s e-commerce business is in trouble. Amazon’s Q3 revenue for 2022 was $127.1 billion, below the consensus of $127.64 billion. Net income was $2.872 billion, down 9 percent from a year earlier. The first three quarters of this year have not been very positive for Amazon. It has lost $3 billion in the first three quarters of this year after posting its first Q1 loss in seven years. That compares with $33 billion in 2021 and $21 billion in 2020. After the release of Q3 financial results in 2022, Amazon’s stock price fell from a high of $120.6 / share in October to a low of $86.14 / share and rose to the current $95.5 / share after Black Friday, while its market value fell from the high of $1.88 trillion in July 2021 to $974.3 billion, with the market value of nearly $1 trillion evaporated. Amazon’s losses were concentrated in its e-commerce business. Its global losses widened 171 percent in the third quarter from a year earlier, with losses in North America widening to $412m, while AWS, the mainstay of Amazon’s profits, also slowed.

Amazon’s losses were also attributed to “rising costs such as Labour and logistics.” During the pandemic, Amazon grew from 800,000 employees in 2019 to 1.6 million in 2021 due to an explosion in demand for online delivery, according to the financial results. But this year, the global pandemic has slowed down, and consumers have returned to offline spending. In the first two quarters of this year, Amazon reduced its workforce by 99,000 people. Just one week before Black Friday, according to media reports, Amazon laid off about 10,000 people, mainly in the device organization, human resources, and core retail departments. Optimistically, Amazon’s move is to return to the essence of corporate management, focusing on reducing costs and increasing efficiency rather than blindly expanding. But the pressure on the next quarter’s earnings may be behind the retail layoffs ahead of a big boost such as Black Friday. There are signs that Black Friday’s impact on Amazon is already limited.

But as the platform with the largest concentration of cross-border e-commerce sellers, many sellers say they want Amazon to maintain its moat and return to its profitable moment. Some sellers have studied segmentation opportunities on Amazon. For sellers, Amazon is still a very important channel, and they even have a close relationship with Amazon. What they can do now is to continue to repair their team and products, wait for the market to warm up, and seize the opportunity.